Whether you’re still building your deposit or feel ready to buy, knowing the steps ahead will help you plan with confidence, you may even be closer than you think!

Am I eligible for pre-approval?

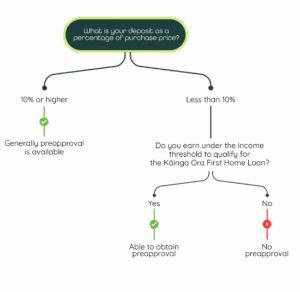

An Enva mortgage adviser can help assess whether your current financial situation meets the criteria for pre-approval. Use the flowchart below as a general guide to check your eligibility:

You can view the requirements for the Kāinga Ora First Home Loan here.

If your circumstances allow, securing pre-approval makes you more competitive in property negotiations. If you’re not eligible yet, don’t worry, your Enva mortgage adviser will help you navigate alternatives, such as making a conditional offer.

Your deposit size and financial settings can also affect what properties and purchasing options are available. The traffic light guide below shows the options avaliable, based on different deposit levels:

Making an application

When you’re ready to apply, your Enva adviser will guide you through the process and the documents you need to provide. To get started, you’ll need to provide proof of income, proof of deposit, bank statements, statement of financial position (also known as a fact find), and identification.

Once your Enva mortgage adviser has reviewed your documents, they’ll let you know if you’re ready to submit an application or confirm that you are ready to go house hunting!

Next steps: Initiating your mortgage application

If your Enva mortgage adviser has determined you should progress to an approval (e.g. with a live contract) or a pre-approval, here’s what to expect:

Let’s get started

When you’re ready, email mortgages@enva.co.nz and we’ll send you the checklist of requirements, along with instructions for sending your documents securely. At Enva Mortgages, we’re here to support you through every step of your first-home journey.

Have questions? Call us on 0508 287 672 or complete the form below, we’d love to help.

Need more support? Check out our First Home Buyers Guide for step-by-step help on your journey to home ownership.

*The information contained in this blog is for general information purposes only. It is not intended to constitute financial advice and does not take your individual circumstances and financial situation into account. We encourage you to seek assistance from a trusted financial adviser.

Fill out your details below and we’ll be in touch soon.

"*" indicates required fields